Most people save without direction, setting aside a little for emergencies and a little for the future, but without a clear goal, saving often feels endless. You might know what you want (a house, your child’s education, or early retirement), but not how much it will actually cost or how long it’ll take to get there. That’s where a Goal-Based SIP Calculator changes everything.

Instead of guessing or relying on inconsistent savings, this calculator helps you create a structured investment plan that is directly tied to your financial goals. Whether your dream is three years away or fifteen, it shows precisely how much you need to invest each month to reach it comfortably, based on realistic returns and Pakistan’s inflation trends.

Pakistan’s financial landscape is constantly evolving, and the costs of education, healthcare, and housing are rising steadily, while traditional savings often struggle to keep pace. This makes planning your long-term goals more important than ever. A goal-based investment approach helps you stay prepared, ensuring your money grows with purpose rather than simply sitting idle in a bank account.

A Systematic Investment Plan (SIP) allows you to invest small, consistent amounts in mutual funds, leveraging the power of compounding and promoting disciplined growth. The Goal-Based SIP Calculator handles all the complicated math for you. Simply enter your target goal amount, time horizon, and expected rate of return, and it instantly calculates how much you need to invest monthly to achieve it, no spreadsheets, no guesswork, just clarity.

Whether you’re saving for your child’s university fees, a down payment on a house, or your retirement savings, this tool helps transform vague intentions into measurable, achievable financial targets. In short, it enables you to stop saving blindly and start investing with purpose.

A Goal-Based SIP Calculator helps you plan investments around specific life goals rather than vague savings targets. It calculates the exact amount you need to invest every month to achieve a future goal, whether it’s buying a house, funding your child’s education, or planning your retirement, based on how much time you have and the expected return on your investment.

Let’s see how this works in real numbers using two simple examples.

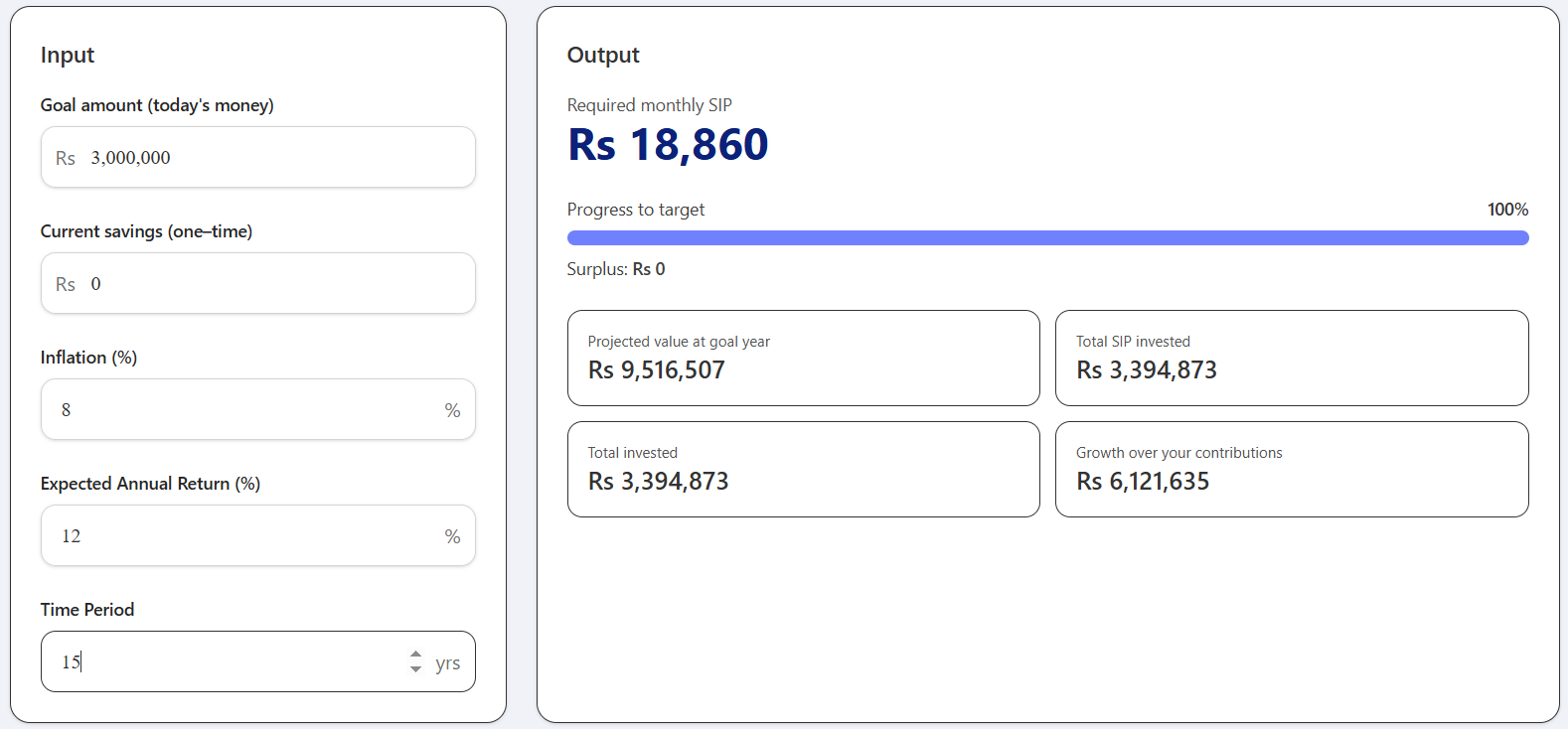

Let’s say your goal is to accumulate PKR 3 million over the next 15 years, maybe for your child’s university education, your first home, or retirement savings. You enter the following details into the Goal-Based SIP Calculator:

Goal amount: PKR 3,000,000

Current savings: PKR 0

Inflation: 8%

Expected annual return: 12%

Time period: 15 years

Here’s what the calculator shows:

Required monthly SIP: PKR 18,860

Total SIP invested: PKR 3,394,873

Projected value at goal year: PKR 9,516,507

Growth over your contributions: PKR 6,121,635

This means that even without any existing savings, a consistent monthly investment of around PKR 18,860 for 15 years can help you build over PKR 9.5 million. The higher inflation rate naturally increases your required SIP, but disciplined investing still ensures your money outpaces inflation and grows steadily over time.

Now, let’s consider the same goal, building PKR 3 million over the next 15 years, but this time, you already have PKR 200,000 saved. Using the Goal-Based SIP Calculator, you enter:

Goal amount: PKR 3,000,000

Current savings: PKR 200,000

Inflation: 8%

Expected annual return: 12%

Time period: 15 years

Here’s what the calculator shows:

Required monthly SIP: PKR 16,484

Total SIP invested: PKR 2,967,090

Total invested (including current savings): PKR 3,167,090

Projected value at goal year: PKR 9,516,507

Growth over your contributions: PKR 6,349,417

By starting with PKR 200,000 upfront, your required monthly SIP drops from PKR 18,860 (if starting with zero) to PKR 16,484. That’s a difference of about PKR 28,500 per year in monthly commitments, showing how even a modest initial saving can ease your financial burden while still achieving the same long-term goal.

The Goal-Based SIP Calculator helps you plan investments in minutes. Here’s how you can use it effectively to set and achieve your financial goals:

Add the total amount you want to achieve in today’s money.

If you already have some savings toward this goal, enter the amount here.

Enter a realistic estimate for long-term inflation.

Use the return rate you expect from your mutual fund or investment plan.

Decide how long you plan to stay invested.

The calculator will instantly show you:

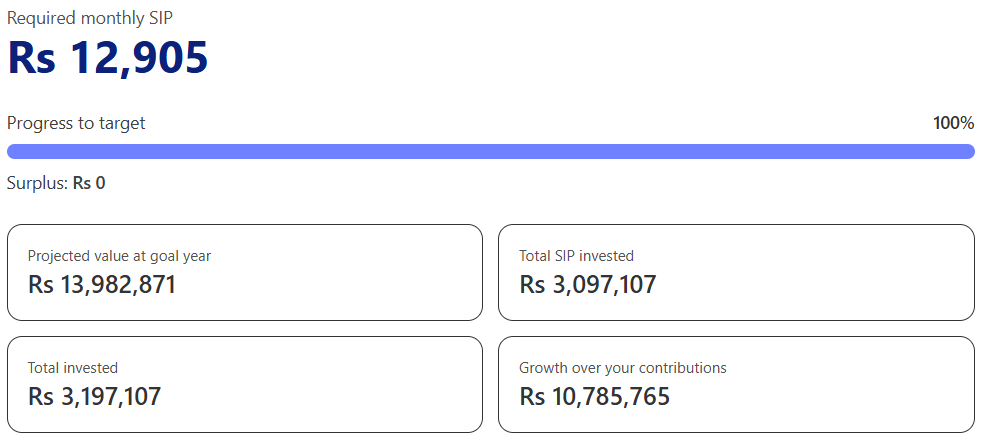

Example: Goal Rs 3,000,000 | Current savings Rs 0 | Inflation 8% | Return 12% | Time 20 years

Notice the difference when you start with zero savings, your required monthly SIP rises to Rs 13,995, compared to Rs 12,905 when you begin with just Rs 100,000. That’s an extra Rs 1,000 every month (around Rs 12,000 per year), a cost you pay simply for delaying or skipping your initial savings.

Investing without direction is risky in a country where inflation and currency fluctuations can quietly erode savings. A Goal-Based SIP doesn’t just help you invest, it gives your money purpose and structure.

At its core, a Goal-Based SIP Calculator isn’t just a financial tool, it’s a roadmap for your future. It bridges the gap between where you are and where you want to be, with clarity, discipline, and purpose.

In Pakistan’s evolving economy, where inflation and uncertainty often challenge long-term planning, structured investing gives you control. Whether you’re starting with zero savings or already have a head start, every SIP installment brings you one step closer to your goal.

The sooner you begin, the lighter your monthly effort, and the larger your reward. Use the Harvest Goal-Based SIP Calculator today to define your dreams, calculate your plan, and start building real wealth that serves your life, not just your bank account.

Start now. Start small. Stay consistent, and let time do the compounding for you.